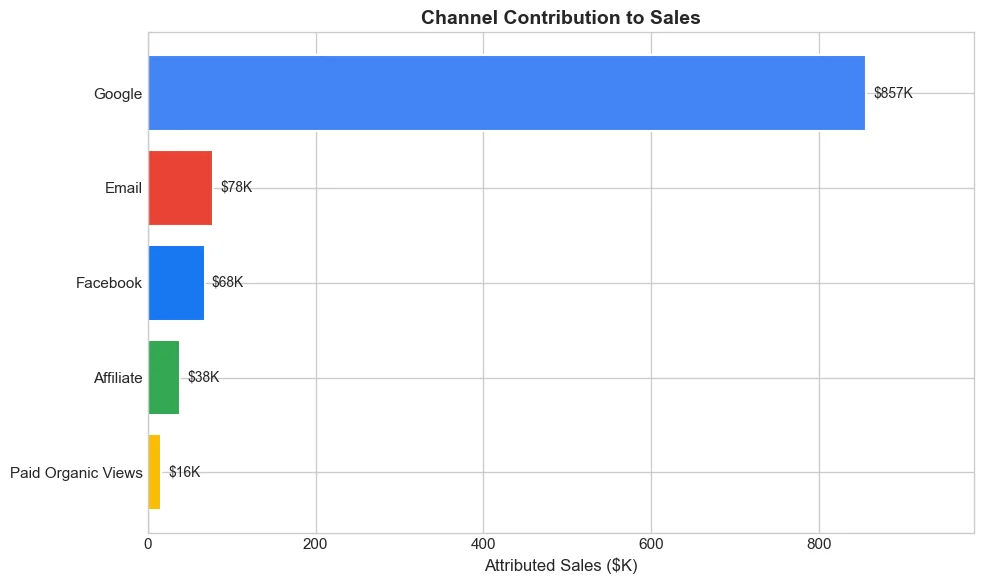

Email was consuming 39% of impressions for 7% of attributed sales. The model found it.

An established DTC home decor brand came to us with a familiar problem: Meta said one thing, GA4 said another, Shopify said something else. They had been running paid media across five channels for years, built a large email list, and hit eight figures in revenue. But they had no idea which channels were actually driving growth versus taking credit for customers who would have bought anyway.

The Problem

This was a mature DTC home decor brand. The kind of purchase people research before buying. Average order value north of $150, strong holiday seasonality, and a loyal customer base built over several years.

They had done the work. CAPI was set up. UTMs were (mostly) clean. They were running Google, Meta, Email, Affiliate, and Paid Views across a mature marketing operation. But the numbers still did not reconcile.

The real question was not "what is working." It was "how much of our revenue would happen anyway, and which channels are actually moving the needle versus taking credit for existing demand."

With 81% of sales coming from baseline demand (repeat customers, organic search, word-of-mouth), getting channel attribution wrong meant potentially wasting budget on channels that were just capturing demand they did not create.

What We Built

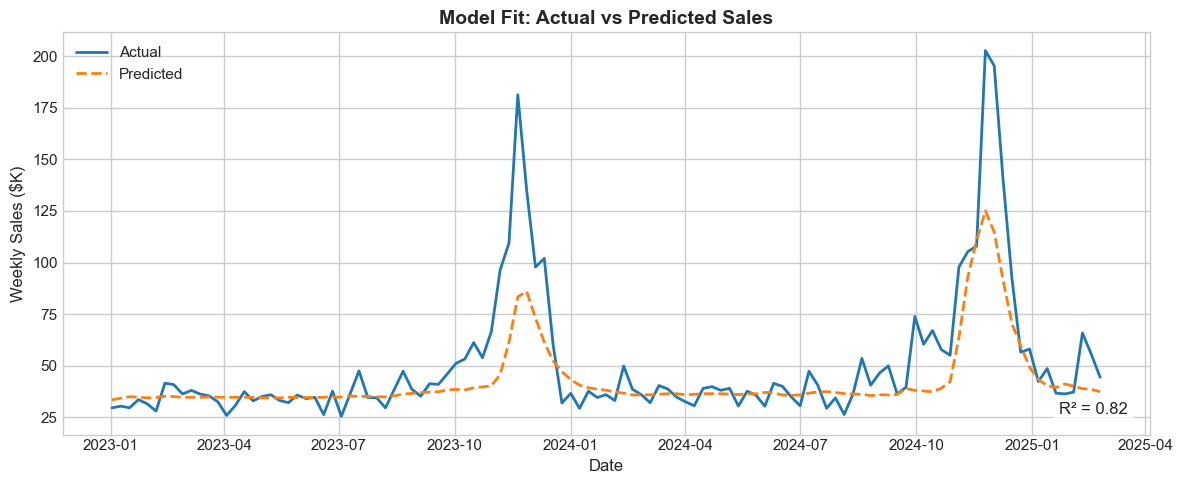

Bayesian Marketing Mix Model in PyMC. 113 weeks of data, January 2023 through March 2025. Five channels measured on impressions.

- Adstock transformation geometric decay with channel-specific retention to capture how advertising effects persist

- Saturation curves Hill function with channel-specific parameters to model diminishing returns

- Seasonality controls Fourier terms for annual patterns plus holiday indicators

- Bayesian estimation NUTS sampler, 2 chains × 2,000 draws, proper uncertainty on every estimate

The model explained 87% of weekly sales variance. 14% mean absolute error. Solid for this type of analysis.

What We Found

| Channel | % Impressions | % Attributed Sales | Flag |

|---|---|---|---|

| 43% | 81% | Validate carryover ~15 week decay is longer than typical paid search. For a considered purchase like home decor, customers research for weeks before buying. Google is capturing that intent, but how much is it creating? | |

| 39% | 7% | Volume/efficiency gap Years of list-building created a large but fatigued audience. Most recipients are existing customers who would buy anywayemail is getting credit, not creating demand. | |

| 15% | 6% | Proportional Contribution matches impression share. | |

| Affiliate | 2% | 4% | Test incrementality High efficiency at small scale often reflects demand capture. |

| Paid Views | 1% | 2% | Small scale Too small for confident conclusions. |

Baseline (non-media demand) accounted for ~81% of total sales. This is typical for an established brand with strong organic demand. Years of brand-building, repeat customers, and word-of-mouth mean most revenue would happen without any paid media. The strategic question becomes: which 19% of media spend is actually incremental, and which is just taking credit?

Diminishing Returns

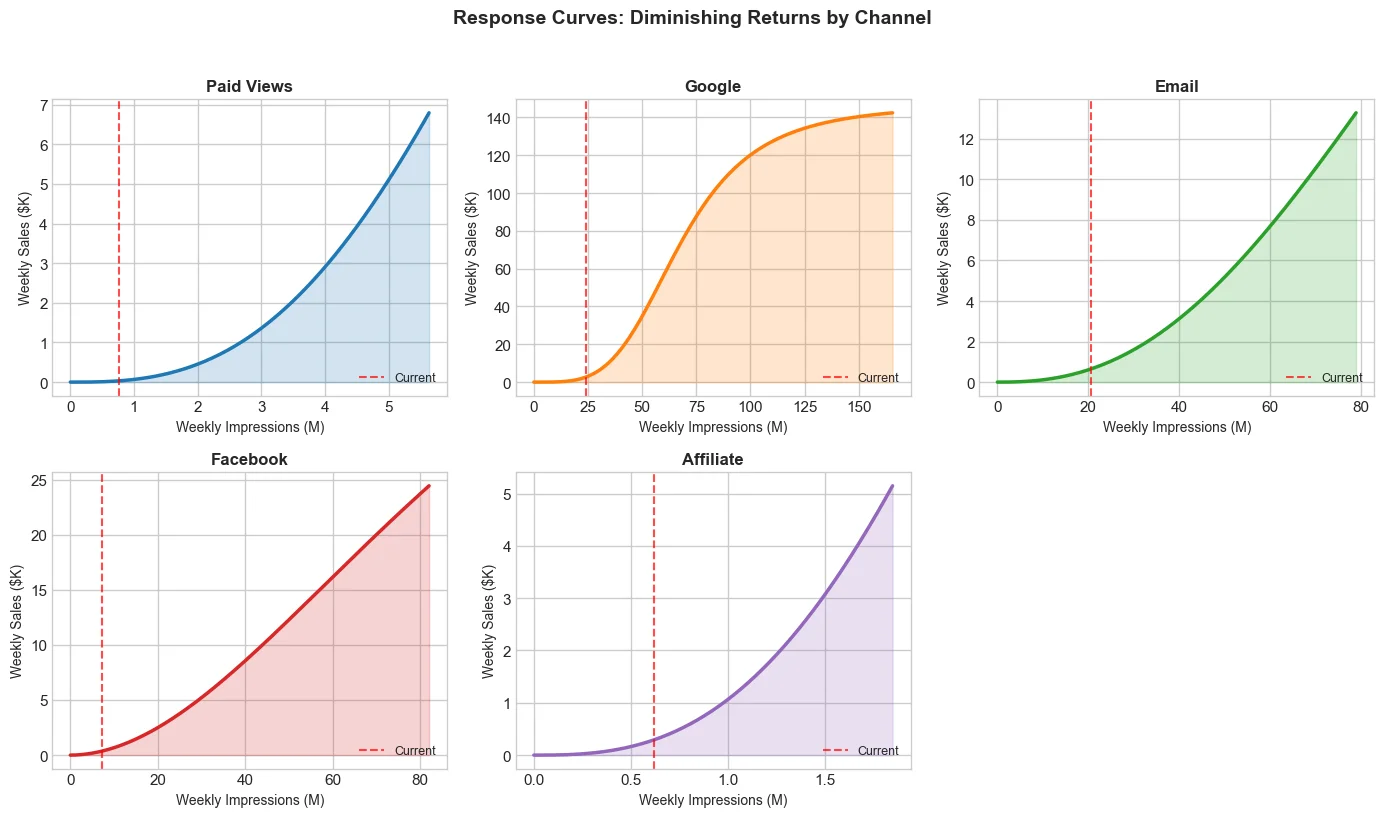

Response curves show how each channel's marginal impact changes with volume. Red dashed line marks current levels.

Optimizer Output

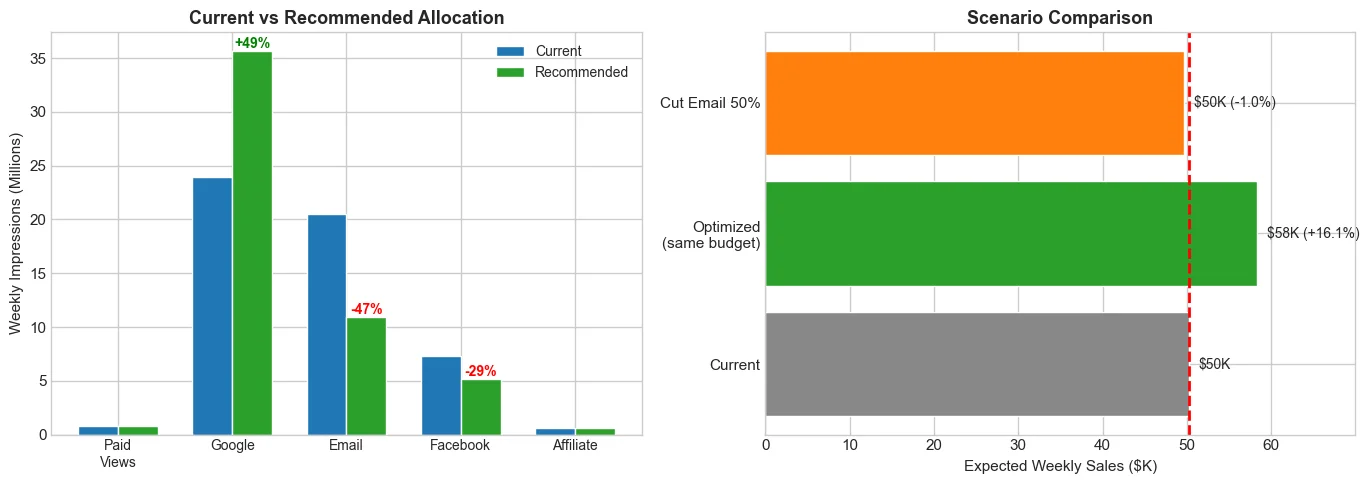

The model suggests reallocating impressions toward Google and away from Email/Facebook. Important caveat: this operates on impressions, not dollars. Email is fixed-cost (SaaS), so "savings" there do not fund other channels.

Recommendations

Execute Now

Reduce email frequency 20-30%. No budget impact (fixed SaaS cost). The list is large but fatiguedmostly existing customers who already know the brand. Cutting frequency tests whether engagement improves and whether those sales were incremental or would have happened anyway.

Test First

Google geo-holdout. Pause Google in 2-3 regions for 6-8 weeks. For home decor where customers research for weeks before buying, the 15-week carryover could be real. Or it could be brand search capturing existing intent. A geo-test isolates the truth.

Test First

Affiliate incrementality. Promo code holdouts or matched market tests. Confirm the channel is creating demand, not just capturing existing intent.

Hold

No large budget shifts yet. The model projects ~15% uplift from reallocation. That is contingent on assumptions that need validation first.

Outcome

The model projected approximately 15% sales uplift from optimal impression reallocation. We were clear with the client: that is a model projection, not a guarantee.

The real value was not the specific number. It was having a framework for where to test instead of guessing.

The team walked away with:

- Clear evidence that email volume needed to come down

- A specific test design for validating Google's true contribution

- Confidence to hold budget steady until they had real incrementality data

- Response curves showing diminishing returns thresholds for each channel